Introduction

In the world of investing, finding a stock that offers long-term gains and stability is like striking gold. FintechZoom Costco stock has been catching the attention of investors looking for just that. With a solid track record and consistent performance in the market, Costco has established itself as a leader in the retail industry, making its stock an attractive option for those seeking to build wealth over time.

Understanding the Costco Business Model

At its core, Costco’s approach to retail hinges on a membership-based structure, a strategy that has positioned the company for sustained success. Members pay an annual fee, granting them access to a wide range of products and services at significantly reduced prices. This model isn’t just about offering discounts; it’s a deliberate move to cultivate a dedicated consumer base that values the cost-saving benefits of bulk purchasing. Such a strategy ensures a predictable and continuous revenue stream, a rarity in the often unpredictable retail sector.

Costco’s ability to maintain low prices without sacrificing quality is another pillar of its business model. This balance is achieved through strategic purchasing and a limited selection of SKUs (Stock Keeping Units), which allows for volume buying and subsequently, lower costs. This approach not only reinforces customer loyalty but also streamlines operations, contributing to Costco’s efficiency and cost-effectiveness.

Moreover, Costco’s emphasis on selling a curated selection of merchandise, from groceries to electronics, under one roof, enhances shopping convenience, further solidifying its appeal to members. The membership model also creates an ecosystem in which customer data can be leveraged to improve product offerings and shopping experiences, fostering a cycle of satisfaction and loyalty.

In essence, Costco’s business model is a masterclass in leveraging membership for mutual benefit. It underscores a commitment to value, quality, and efficiency that resonates with consumers and sets Costco apart in the competitive landscape of retail.

FintechZoom Costco Stock Performance Analysis

FintechZoom’s analysis of Costco’s stock reveals a history of consistent financial growth, making it an appealing choice for investors with an eye on long-term stability and returns. The company has demonstrated an impressive ability to sustain revenue and earnings growth, which in turn has translated into robust stock performance. Particularly noteworthy is Costco’s resilience during periods of economic uncertainty, where it has often outperformed its peers in the retail sector. This durability is a testament to Costco’s solid foundation and its strategic business operations, which include maintaining a strong balance between quality and price, and a focus on bulk selling that appeals to a wide range of consumers.

An examination of Costco’s stock trajectory over recent years highlights a pattern of steady appreciation, punctuated by a commendable track record of returning value to shareholders through both dividends and share repurchases. This commitment to shareholder value, combined with Costco’s unwavering operational success, positions FintechZoom Costco stock as a compelling option for those seeking to diversify their portfolio with a reliable retail sector investment. Moreover, Costco’s adept handling of market shifts and consumer trends further underscores the company’s financial savvy and strategic foresight, characteristics that are critical for sustaining long-term stock performance. Investors monitoring the market can observe that despite the evolving retail landscape, Costco continues to leverage its unique business model to maintain a competitive edge and drive shareholder value.

The Role of Costco in the Retail Sector

Costco’s distinctive strategy within the retail sector has significantly impacted how businesses and consumers approach bulk purchasing. Unlike traditional retail outlets, Costco’s wholesale model emphasizes selling products in larger quantities at lower prices, a tactic that has not only broadened its customer base but has also set a new standard in retail efficiency. This approach has been instrumental in enabling Costco to maintain a strong competitive position, especially against both brick-and-mortar rivals and e-commerce platforms. The company’s commitment to offering value through high-quality products at competitive prices has fostered a culture of loyalty among its members, contributing to its resilient performance even as the retail landscape evolves.

Further differentiating itself, Costco places a high emphasis on ethical business practices, including fair treatment of employees, sustainable sourcing, and community engagement. These practices enhance Costco’s reputation and appeal, encouraging a more socially conscious consumer base to align with the brand. Additionally, Costco’s innovative use of technology to streamline operations and improve the shopping experience has allowed it to stay relevant in a sector that is increasingly moving online. By integrating online shopping with its traditional warehouse model, Costco has effectively expanded its reach and convenience, further cementing its role as a key player in the retail industry.

The company’s adeptness at navigating market trends and consumer preferences, coupled with its strategic expansion both domestically and internationally, showcases Costco’s influential role in shaping the future direction of the retail sector. Its ability to consistently meet consumer demands while maintaining operational excellence and strategic growth initiatives illustrates why Costco continues to stand out in a crowded marketplace.

Why Investors are Drawn to Costco Stock

The allure of FintechZoom Costco stock among investors is multifaceted, transcending mere brand recognition to encompass the intrinsic financial health and operational prowess of the company. The consistent upward trajectory of Costco’s financial performance, characterized by stable growth in revenue and earnings, serves as a beacon for those looking to invest in a stock with the promise of long-term appreciation. Beyond financial metrics, the strength of Costco’s business model – a membership-based ecosystem designed for bulk purchases – offers a unique value proposition that has proven resilient against the ebbs and flows of economic cycles and consumer trends.

Moreover, the company’s dedication to maintaining a strong balance between offering quality goods at competitive prices and ethical business practices enhances its appeal to a broader demographic of socially conscious investors. This blend of operational excellence and principled governance has enabled Costco to forge a deep sense of loyalty among its customer base, which, in turn, translates to a stable and growing income stream for the company and its shareholders.

The strategic foresight exhibited by Costco in adapting to the digital retail landscape while preserving the essence of its warehouse shopping experience further underscores its potential for sustained growth. This adaptability, coupled with strategic international expansions, positions Costco favorably for tapping into new markets and demographic segments. For investors, these attributes signify not just a robust investment opportunity but also align with a growing preference for supporting companies that demonstrate a commitment to sustainability, innovation, and consumer satisfaction.

Potential Challenges and Risks for Costco Investors

Navigating the investment landscape of FintechZoom Costco stock demands a nuanced understanding of the hurdles it may face. Despite its robust performance and strategic resilience, several external factors could pose significant threats to Costco’s sustained growth and profitability. The retail industry is notoriously competitive, with both established players and new entrants continuously innovating to capture market share. As other retailers refine their business models and operational efficiencies, the unique advantage Costco holds through its membership-based approach and bulk selling could be challenged, potentially impacting its market dominance.

Additionally, macroeconomic fluctuations play a crucial role in consumer spending patterns. An economic downturn could lead to tightened household budgets, directly affecting discretionary spending and, by extension, Costco’s sales volumes. Such economic shifts may test Costco’s ability to maintain its growth trajectory and appeal to cost-conscious consumers without compromising on quality or value.

Another area of concern includes the logistics and supply chain vulnerabilities that are inherent in global retail operations. Disruptions, whether from geopolitical tensions, natural disasters, or public health crises, can lead to inventory shortages, increased costs, and operational bottlenecks. These issues not only strain Costco’s ability to meet consumer demand but also could erode profit margins over time.

Regulatory changes also present a potential risk, as increased scrutiny or new policies related to trade, labor, and environmental standards could necessitate adjustments in Costco’s business practices, potentially inflating operational costs or limiting expansion opportunities.

Investors must weigh these challenges carefully, recognizing that while Costco’s past performance and strategic initiatives provide a strong foundation, the dynamic nature of the retail sector and broader economic environment carry inherent risks.

Must Read: Tymoff’s Guide to Personal Growth: ‘Self-Control is Strength. Calmness is Mastery. You’

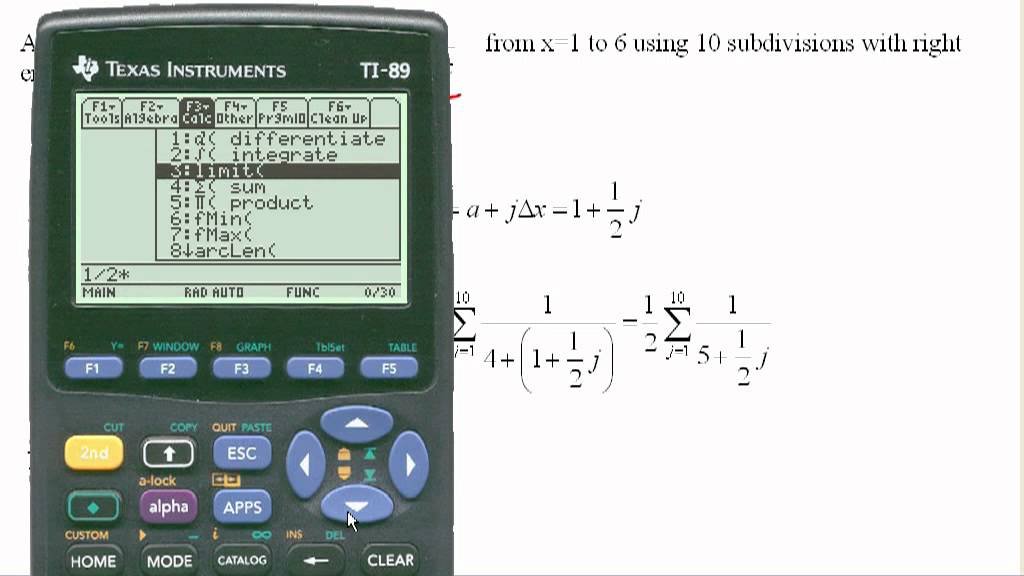

How to Start Investing in FintechZoom Costco Stock

Embarking on the journey of investing in FintechZoom Costco stock begins with a foundation of comprehensive research. Delve into Costco’s recent financial reports, evaluating its performance metrics such as revenue growth, profit margins, and dividend yield. Understanding the nuances of its business model and how it stacks up against competitors will further inform your investment strategy. Consideration of your personal financial objectives and risk appetite is crucial in determining how Costco fits within your broader portfolio. Engaging with a financial advisor can offer tailored advice, leveraging their expertise to navigate the complexities of the stock market. They can assist in setting up a brokerage account if you don’t already have one, providing a direct pathway to purchasing Costco shares. Through thoughtful analysis and strategic planning, you can confidently take steps towards adding FintechZoom Costco stock to your investment mix, aiming for long-term financial growth.